Success Tax Professionals Gosford

John Lee is the accounting principal of Success Tax Professionals in Gosford, NSW. The practice, located at Shop 2, 110 Erina Street E (E – stands for east) provides services in English and Korean and is located in front of the Gosford Shopping Centre in the CBD and only five minutes walk from the train station.

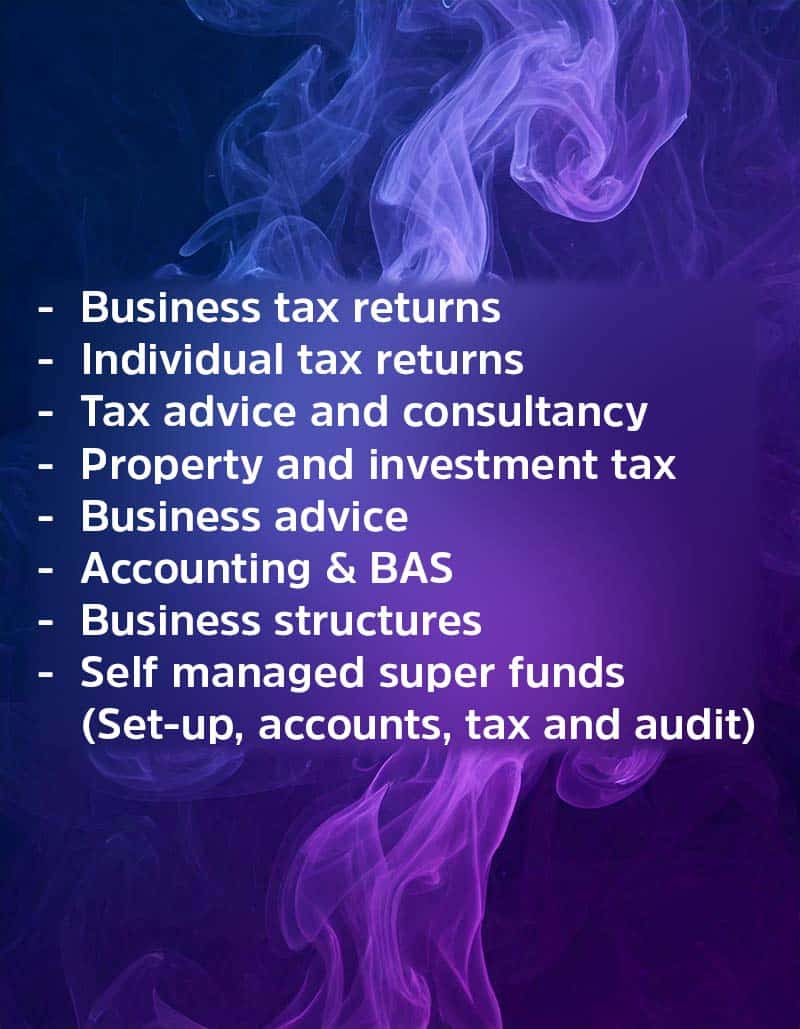

The practice has special interests in:

- Business advisory

- Business structure set-up

- Tax planning

- BAS/GST and income activity statements

- Tax returns

- SMSFs

‘The suburb of Gosford is experiencing a significant transformation to a regional commercial hub. It has become an appealing area for innovative entrepreneurs from various backgrounds. Our practice has a strong focus on becoming the “trusted adviser or trusted business partner” for our clients. We do this by regularly completing highly targeted training to constantly upskill and use the most effective concepts and strategies. Accuracy, interpretation and application of the information can bring about significant positive changes.

‘It’s a typical statement that all clients have unique circumstances. This goes without saying. By having a special interest in business advisory, for example, our practice extends its services well beyond compliance and into solving problems, investigating improvement opportunities, and presenting solutions and planning options,’ says John Lee, the principal.

John Lee is a local member of the Gosford community – a church member and active member of East Gosford Soccer Club, ‘RAM’. He is well qualified with a Bachelor of Business, Master of Accounting and Post Graduate Diploma in Translating and Interpreting (Korean to English and vice versa). He is a member of CPA Australia and AICPA (American Institute of CPA).

John adds, ‘Our services are in English but with fluent Korean speaking staff we are also very well equipped to help Korean clients who may be challenged by language issues. We welcome businesses and individuals. We also help business owners assimilate into the area, for example, if moving into the Gosford, Woy Woy and Erina areas. We can arrange for transfer of their services to us if they prefer having their accounting and taxation under the management of our practice, as a local service provider, who they can easily contact and visit in person.’

Slideshow gallery

(Mouse over image to pause)

Details

Gosford NSW 2250

Australia

Phone: 02 4322 1958

Mobile: 0421 974 274

Email: [email protected]

Info: Tax Agent No. 25950940. Languages - English and Korean.

Servicing Options

- In person at our office

- Phone

- Online video

- We use Zoom

Find our office

Read our reviews

Interested in saving more tax than compliance services offer?

What are compliance services?

Compliance services are services that meet your obligations set by government and various departments such as the Australian Taxation Office – for example, lodging a tax return, BAS statement and so on. You have to do these things.

Significant tax savings and benefits

But if you really want to get savvy about saving tax you can ask us about tax planning and business advisory services. These services are very different to compliance services. They are optional services that can produce very significant savings and benefits. Why? Because your circumstances are profiled against a range of strategies and specific strategies are identified that can clearly save tax or produce compelling outcomes. You can see the estimated savings in advance and the cost to implement the changes required.

Tax Planning

Tax planning can be for individuals such as retirees, investors, property owners and businesses. We can tell you quickly if you fit a category that has workable solutions for improvement.

Business Advisory

Business advisory is for businesses and amongst other key areas it finds the ways profitability can be improved. Your business can also be benchmarked against similar businesses and a range of factors identified and worked on to really advance your business and its results. This relates to all businesses – whether you are happy with performance or not, there are typically a range of changes that can really make a difference. This also includes protecting your business.

Ask about tax planning or business advisory today.