Blog

Want to grow revenue without chasing more clients? Master the art of upselling.

Here’s how to upsell effectively and ethically: Understand your clients – Know their pain points, goals, and service history Pick the right moment – Offer upgrades ...

Still running your business from spreadsheets, sticky notes, and memory?

It's time to step into leadership — and an automated customer relationship management (CRM) system can get you there. Here’s how a CRM transforms ...

Rentvesting: live where you want, invest where it makes sense

More Australians are turning to rentvesting as a smart way to build long-term wealth without sacrificing lifestyle. Here’s how it works: Rent where you want to ...

Why every adult should have a legally prepared will

Did you know that dying without a will — known as dying intestate — means the state decides who receives your assets? A properly prepared legal will ensures your wishes are respected ...

Want to retire early and live life on your terms?

The FIRE movement (Financial Independence, Retire Early) is about building enough wealth to stop working decades before traditional retirement age. It’s not a dream—it’s a strategy. ...

Thinking about setting up a family trust?

Here’s why many Australians choose a discretionary trust to grow and protect their family wealth: Distribute income tax-effectively – Allocate income each year to family members in ...

Want to build real wealth and reduce financial stress? Start by diversifying your income streams.

Most people rely on a single source of income, like their job or business. But what happens if that income stops or slows down? ...

Downsizing your home could save you thousands but it takes more than just selling up

If you're thinking about simplifying your lifestyle, retiring soon, or unlocking equity, downsizing might be the smartest move you make. But how do you ...

Why a subscription model is a game changer

Predictable, recurring revenue No more chasing sales—monthly payments keep cash flow steady. Reduced client acquisition stress Clients subscribe once and stay—no need for constant ...

The fastest way to grow a business?

Help clients increase their average transaction size, and watch their profits soar. At Success tax professionals, we don’t just do tax returns. we help ...

Want to grow your wealth smarter? ETFs could be your secret weapon

Here’s the simple, proven process for investing in exchange traded funds (ETFs), a strategy that’s helping Australians build long-term wealth: Set your goals – ...

Choosing the right super fund: A smart move for your financial future

Are you still with the same super fund by default. It might be costing you thousands. Here’s what smart Australians are doing to build ...

Drowning in debt? Here’s the smart way out that builds wealth too

Debt is expensive. Not just in dollars, but in lost opportunity. If you're juggling credit cards, loans, or buy-now-pay-later traps; debt consolidation might be ...

An emergency fund: the most underrated wealth strategy

Before you invest, scale, or expand, build an emergency fund. Why? Because without a financial buffer, one unexpected hit can wipe out years of ...

What is a binding death benefit nomination (BDBN)?

A binding death benefit nomination (BDBN) is a legal document that directs your super fund to pay your death benefits to specific people or entities. ...

Want to build wealth without relying on willpower? Automate it.

The difference between people who want to save and those who actually build wealth often comes down to one thing: Automation. Here’s how to ...

Why annual valuations are essential for succession planning

Succession planning without a business valuation is like selling a house without knowing the market price. You can't transition a business successfully if you ...

The smart business owner’s guide to annual valuations

If you own a business, you should know what it's worth every year. Annual business valuations aren’t just for sales or tax purposes. They’re ...

Interest costs are silent profit killers. Here’s how to fight back

Most businesses don’t realise how much interest is eating into their cash flow — until it’s too late: High-cost debt quietly drains your profits. ...

Want to retire with $2 million? Here’s how smart Australians are making it happen

$2 million isn’t just a number — it’s the freedom to retire comfortably, live on your terms, and leave a legacy. But it doesn’t ...

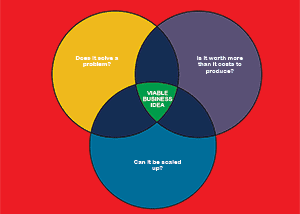

Is your business viable or just surviving?

Practical checklist every business owner should review. Running a business in today’s environment is tough and not every business should be saved. But many ...

Want to build a more profitable, future-ready accounting practice? start by investing in yourself.

The most successful accountants don’t wait for change, they educate themselves, adapt, and lead. Whether you want to grow your advisory income, improve client ...

What Is the debt snowball method?

The debt snowball method is a simple yet powerful debt repayment strategy. Rather than focusing on interest rates, it focuses on momentum. Here’s how ...

How negative gearing creates wealth

While it may seem counterintuitive to invest in something that loses money each year, negative gearing can generate significant wealth through: Tax benefits ...

How to become debt-free and take back control of your life

Drowning in debt? You’re not alone. But you can get out and the debt-free community is proof that everyday people are ditching debt and ...

The power of living below your means: the strategy behind financial freedom

In a world where "more" is constantly marketed as the goal—more stuff, more upgrades, more lifestyle—there’s one timeless principle that quietly builds real wealth: ...

Want to grow your wealth faster? Start by increasing your earning capacity

Raising your income isn’t just about a bigger paycheck - it’s a strategic move that unlocks long-term financial freedom. Here’s how to elevate your ...

Debt recycling: a strategic approach to build wealth, reduce home loans, and minimise tax

Debt is often viewed as a financial burden, particularly when it comes to non-deductible debt like a home loan. However, with the right strategy, ...

Is it time to invest in your commercial premises?

For most Australians, their home is their best financial investment. However, if you operate a business, purchasing your own commercial premises can be one ...

How to leverage debt to build wealth through property investment

Real estate is one of the most powerful wealth-building tools, and smart investors use leverage (borrowed money) to maximize their returns. By using debt ...

The debt avalanche method: crush debt & build wealth faster

Debt can feel like a never-ending burden, but not all debt repayment strategies are created equal. If you want to eliminate debt faster while ...

Want to succeed? surround yourself with the right people

Success isn’t just about what you know, it’s about who you surround yourself with. Your environment shapes your mindset, habits, and opportunities. if you ...

How to create an investment plan that builds wealth

A structured investment plan is the key to growing wealth with clarity and confidence. Without a plan, you risk random investing, emotional decisions, and ...

The 50/30/20 rule: the simple formula for financial freedom

Want to save more, spend smarter, and build wealth—without over-complicating your finances? The 50/30/20 rule is your answer. How It Works: 50% needs – ...

How to avoid lifestyle debt and build real wealth

Lifestyle debt is the silent killer of financial freedom. Borrowing for luxuries, vacations, and status symbols may feel good in the moment—but it leads ...

How to skyrocket your conversion rates & close more deals

Boosting conversions isn’t about working harder, it’s about working smarter. Here’s how to turn prospects into paying customers fast. Build trust & rapport People ...

Stop working in your business & start working on it

Most business owners are trapped in their own success - working harder, not smarter. If you’re drowning in daily operations, it’s time to shift ...

Unlock explosive sales growth with customer segmentation

In today’s competitive landscape, knowing your customers isn’t just an advantage - it’s essential. Smart customer segmentation empowers you to deliver laser-focused marketing, dynamic ...

Boost customer retention and drive sales with these key strategies

Customer retention is the secret sauce behind long-term business success. Loyal customers not only make repeat purchases but also advocate for your brand - ...

Prenuptial agreement (BFA) – the wealth protection strategy couples overlook

Love is priceless, but your assets aren’t. Protecting your financial future isn’t about a lack of trust, it’s about smart planning. In Australia, a ...

10 proven ways to skyrocket your net worth & achieve financial freedom

Most people stay broke because they follow outdated financial advice. The wealthy play by a different set of rules. If you want to break ...

Reduce business costs with electric vehicles (EVs)!

Switching to electric vehicles (EVs) isn’t just good for the planet—it’s smart for your bottom line. Businesses using EVs save thousands in fuel, maintenance, ...

Turn bad debt into good debt – A game-changer for your finances!

Debt can work for you or work against you. The key? Converting bad debt into good debt so you can grow wealth, ...

Top 10 technologies for Australian accountants

Accounting technology is rapidly evolving, enabling accountants to streamline processes, improve efficiency, and provide better services to clients. Here are the top 10 ...

Navigating business strategy amidst shifting government policies, budgets, and tax policies

Navigating business strategy amidst shifting government policies, budgets, and tax policies can indeed pose significant challenges. However, there are several approaches businesses can take ...

15 different ways to compete in business

Competing in business involves various strategies and approaches depending on factors like industry, market conditions, and company goals. Here are fifteen different ways to ...

Tax planning and business advisory services

Tax planning The primary goal of tax planning is to optimize a business's financial situation by minimizing its tax liability within the legal framework. ...

What questions should I be asking my accountant?

When meeting with your accountant, it's important to ask questions that can help you understand your financial situation, make informed decisions, and ensure compliance ...

Business exit planning

Business exit planning prepares for a business's eventual sale, transition, or discontinuation. It involves creating a comprehensive plan to maximize the value of the ...

Location, location, location

Choosing a business location is crucial for several reasons: Visibility and accessibility: The location of a business can significantly impact its visibility and accessibility ...

Benefits of buying your business premises.

Buying their premises can offer several benefits to businesses, including: Stability and control: Owning your premises provides stability and control over your business location. ...

How does inflation affect small business

Inflation can have various effects on small businesses, and these impacts can be both positive and negative. Here are some ways in which inflation ...

What is a buy-sell agreement?

A buy-sell agreement, also known as a buyout agreement, is a legal contract that outlines the terms and conditions under which the ownership interest ...

10 reasons to buy your business premises

Buying their premises can offer several benefits to businesses, including: Stability and control: Owning your premises provides stability and control over your business location. ...

Why should you get a business valuation?

Business valuations are the process of determining the economic value of a company or business. The valuation process involves analysing a wide range of ...

Key Factors Influencing Business Saleability

Financial performance: Revenue growth, profitability, and a well-maintained financial record can positively influence saleability. Market position: Brand reputation, customer base, a strong market presence, ...

Work on the business, not in it

The phrase "work on the business, not in it" comes from Michael E. Gerber's book, "The E-Myth Revisited." Its core message revolves around the ...

Binding death benefit nominations

A 'death benefit nomination' is a legal document that allows a superannuation fund member to specify who should receive their superannuation benefits in the ...

Measure and compare performance with benchmarking

Benchmarking is a systematic process organisations use to measure and compare their performance against that of their peers or industry leaders. The primary goal ...

Avoid underpaying employees

Underpaying employees occurs when workers are paid less than the minimum wage or are not provided with their correct entitlements and benefits as ...

Avoid penalties with an ATO payment plan

An ATO payment plan allows you to break down your payment into smaller amounts made via instalments and spread over a fixed period. Within ...

Safeguard your assets with an asset protection plan

Asset protection refers to the strategies used to safeguard wealth and assets from potential risks, such as lawsuits, creditors, and financial downturns. Asset protection ...

Navigate the complex world of insurance with an insurance broker

Insurance brokers act as intermediaries between individuals or businesses seeking insurance coverage and insurance companies. Their primary role is to help clients navigate the ...

Discretionary trusts – ensure trust distribution resolutions are signed before 30th June

Discretionary trusts (often referred to as family trusts) must ensure that by 30th June of each financial year, the trust income is appropriately distributed ...

Witchcraft tax deductions

Witchcraft is the practice of magical skills, spells, and abilities. In the Netherlands, witchcraft expenses are tax-deductible if they are likely to increase the ...

Chopstick Tax

In 2006, China introduced a 5% tax on disposable wooden chopsticks to reduce demand for wooden chopsticks to preserve their shrinking forests. This is ...

The Isle of Man has a tax cap of £120,000

The Isle of Man, also known simply as Mann, is a self-governing crown dependency between England and Northern Ireland in the Irish Sea. Under ...

Webcam strippers tax

In 2009 Sweden introduced the webcam strippers tax to tax online sexual services. Although prostitution is illegal in Sweden, online or offline, stripping is ...

Transgender Pakistan tax collectors

Avoiding paying taxes is a way of life in Pakistan. Less than 1 per cent of its 180 million citizens currently pay any income ...

Metabo Law to decrease Japan’s obesity rates

In 2008 the Japanese Ministry of Health, Labour and Welfare introduced the ‘Metabo Law’ to decrease Japan’s obesity rates. The ‘Metabo law’ is, in ...

Have you heard of the cow flatulence tax?

In 2009 the Danish Tax Commission proposed introducing a cow flatulence tax of $110 per cow per year. For the average farmer with 120 ...

TeaPot party

Willie Hugh Nelson (c1933-) is an American musician, singer, songwriter, author, poet, actor, and activist. The critical success of the album Shotgun Willie (1973), ...

The UK has a bedroom tax!

In 2012 the United Kingdom (UK) introduced the bedroom tax to free up public housing (1 million spare bedrooms) and reduce the Government’s public ...

Tethered hot air balloon tax

Kansas (in the United States of America) taxes sales of admissions to any place providing amusement, entertainment or recreation services. Hot air ballooning squarely ...

China’s mooncake tax

In 2011 China introduced the ‘mooncake tax’ which taxes employees on any employer-provided allowances and benefits. Previously, employee allowances and benefits were tax-deductible to ...

Marijuana tax

In the United States (US), the possession of cannabis is illegal under the Federal Controlled Substances Act of 1970. In contrast to the Federal ...

The Fair Tax Mark was established in the UK in 2014

Community attitudes to tax avoidance vary from approval through neutrality to outright hostility. Opinions may differ depending on the steps taken in the avoidance ...

Solar Tax – A tax on the sun!

In 2015 Spain introduced a solar tax (‘impuesto al sol’) which taxed owners of solar panels on their consumption of electricity. The solar tax’s ...

Sustainable tourism tax

In 2016, the Balearic Government introduced the ‘Sustainable tourism tax’ which applies a levy on all overnight stays in tourist accommodation on the Balearic ...

Federal Budget 2023-24 Tax Changes

The key tax and superannuation changes announced on Tuesday, 9 May 2023 by Treasurer Jim Chalmers are: Small business instant asset write-off: For 2023-24 ...

Pet Tax

In 2017 the Punjab government, a state in Northern India, introduced a tax for keeping domestic animals. People owning a dog, cat, pig, sheep, ...

Blogging Tax

In 2018, Tanzania introduced a USD 900 per year tax on bloggers. A blog is an informal discussion or informational website published on the ...

Social Media Tax

In 2018 the Uganda government introduced a 'Social media tax' to censor online speech. Yoweri Museveni, the president of Uganda, stated that 'the tax ...

Digital Services Tax

In 2019 France introduced a Digital Services Tax (DST), which imposes a three per cent tax on the French revenue of large multinationals that ...

Seasteading and the world’s first floating nation

Seasteading is the concept of creating permanent dwellings at sea, called seasteads, outside the territory claimed by any government. Proposed structures include modified cruise ...

Illegal early access to super

To access your super legally, you must satisfy one of the twelve conditions of release. Generally, you can only access your super when you: ...

Stoicism – The 10 Most Important Practices

Stoicism is a school of Hellenistic philosophy founded in Athens by Zeno of Citium in the early 3rd century BC. The Stoics taught that ...

30% tax applies to super fund balances greater than $3m

From the 1st of July 2025, the future earnings of super fund balances greater than $3m will be taxed at 30%. Currently, these earnings ...

Cloud accounting software

Cloud accounting software is a type of accounting software hosted on remote servers and accessed via the Internet, as opposed to traditional accounting software ...

What does the Australian government spend your income tax on?

Percentages vary from year to year based on changes in government policy and the economy but most recently, the highest percentage of funds from ...

Directors duties and the Corporations Act 2001

The Corporations Act 2001 outlines directors' duties and responsibilities in companies' management and operation. These duties ensure that directors act in the company's and ...

Increase productivity and reduce costs with a four-day work week

A four-day workweek is a workplace arrangement whereby employees work four days per week rather than the customary five. Typically this involves having Monday ...

Protect your assets with a pedigree trust

A pedigree trust (also known as a linear descendant's discretionary trust) is a type of discretionary trust established to ensure that the property of ...

FBT exemption for retraining and reskilling staff

Employer expenditure on retraining and reskilling redundant (or soon to be redundant) employees is exempt from FBT. The education or training is not required ...

5 advantages of staff working from home

Having staff work from home reduces office space requirements and reduces rent. Additional advantages include: Increased talent pool - companies can hire the best ...

Crowdfunding for fast growing businesses

Innovative fast growing businesses needing to raise additional capital. Crowdfunding involves using the internet and social media to raise funds for specific projects or ...

What is credit card hacking?

Influences promise a lifetime of luxury and free travel anywhere in the world! What is credit card hacking and is it all it’s cracked ...

Beware of fraudulent BAS clients

Sophisticated criminals are now targeting accountants and registered tax agents to lodge fraudulent business activity statements on their behalf. In some cases, the accountants ...

Top 5 financial resolutions!

Quit the pub – Some of us spend up to $200 on a Friday night at the pub. There were 52 Fridays in 2022 which ...

Five ways to keep your budget in check this holiday season

More than any other holiday, the festive season places financial pressure on our budgets. This year will be a real challenge considering inflation and ...

Did you think you could outsmart the Australian Tax Office?

The Australian Tax Office (ATO) raided 35 Australian businesses in 2022 suspected of using electronic sales suppression tools (ESSTs) to delete business transactions, reduce sales ...

Top 10 reasons to have an end of year function for your business

It’s no secret, small businesses face incredible headwinds going into 2023. You may be tempted to save money and forgo your 2022 end of ...

Don’t pay tax on your Christmas party this year with our FBT hangover cure!

Cutting your tax bill for this year's Christmas Party can be accomplished simply by having your bash on business premises as opposed to an ...

Phasing out written authorisation for agent linking

Agent linking between tax agents and clients is carried out through written authorisation. The ATO will be phasing agent linking out in the wake ...

Are you ready to start a new business?

Starting and running a business requires a lot of work and a huge time commitment. Is self-employment the right choice for you? Do you ...

Director identification numbers to mitigate illegal phoenixing

The Australian Business Registry Services (ABRS) has introduced director identification numbers (director IDs) to cut down on phoenix companies (liquidating a company to avoid paying ...

Why is household spending going up?

Talkback radio will have you believe Australia is in the grips of an affordability crisis. Interest rates keep rising and inflation is at 7.6%. ...

Free small business advisory services

Let’s face it, running a business is expensive and many small businesses can’t afford professional advice. So where can small Australian businesses go when ...

Cash flow will make or break your small business

A cash flow statement shows the ins and outs of your business in real-time. Cash flow is the food and water for your small business and ...

Why is China slashing interest rates?

As the rest of the world tightens monetary policy by hiking interest rates, China is slashing rates. Two rate cuts in August and a ...

Challenges for Australian businesses in 2022

2022 is a tough triple whammy year for small, medium and large businesses in Australia. Businesses, already shaky as they pull themselves out of ...

Simple tax returns to disappear within 3 to 5 years

Chris Jordan, the Commissioner of Taxation, has advised tax agents that 'if your business model is high-volume, low-margin, simple tax returns, your business will ...

The Pros and Cons of a Country Accounting Practice

There are many benefits to moving your accounting practice to the country. Rural accounting also comes with a lot of risk and potential downside, ...

How to manage poor-performing employees

Human capital is often the biggest cost to a business. Employees must perform at their best for your business to succeed. But what if ...

Why don’t stocks trade at their buyout price?

When a company announces they are being bought out by another company at an exact price, say $10 per share, often the share price ...

How to protect yourself from malicious spam emails

Spam emails are unauthorised electronic messages sent in bulk from outside parties. The intent varies, some promote legitimate products or services whilst others link ...

Consumer robotics

Consumer robotics is the practice of developing robots for households, individuals or end consumers rather than commercial outfits. Robotics is very successful in a ...

Conventional vs unconventional monetary policy

Conventional monetary policy is a central bank tool that changes the cost to borrow money (official cash rate/interest rate) to increase or reduce demand. ...

Is it time to switch to wine?

I love a good beer. I’ve got a soft spot for craft ales. Yes, I must confess, I’ve become a beer snob and it’s ...

Should I use myTax or an accountant?

If you’re an individual with a simple income from an employer and nothing to claim, you may decide to lodge your tax online through ...

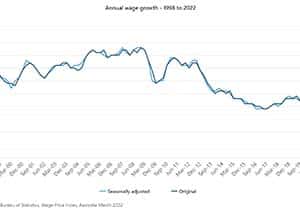

Wage Price Index, Australia (WPI)

The Wage Price Index Australia (WPI) is a measure of the cost of labour not considering compositional changes in the workplace such as part-time vs full-time employment. ...

Top five tax automations in Australia in 2022

Tax time doesn't need to be arduous. Here are the top 5 tax automations for Australians in 2022: Lodge your tax return online with myTax. ...

How much extra will my home loan repayments be?

In Australia and abroad, we have become used to falling interest rates. Now that interest rates are heading back up again, it’s important to ...

Sharp rise in Living Cost Indexes (LCIs)

The Selected Living Cost Indexes (LCIs) in Australia have risen sharply over the last 12 months (3.8%-4.9%). The sharpest LCI rise in a decade. Living Cost ...

Financial markets are crashing, what should I do?

If you have a share portfolio, you might not be sleeping very well as you watch billions disappear from the Australian Stock Exchange ...

How can you guarantee safe shopping online?

A Current Affair has been made aware of an Australian shopping site Home Appliances Plus which has been accepting payment but not sending the products ...

$31.65 for a loaf of bread baked at home

An article in the ABC demonstrates that whilst you may assume that baking bread at home is cheap, if you put a price on labour, a ...

Am I human or computer?

What you’re reading right now is written by me. But am I human or computer? Chances are, you’ve read multiple articles this year written ...

The Howard government was the last to make any real tax reform

The Howard government’s incentive based GST tax policy was Australia’s last substantial tax reform that stood the test of time. Why? Because it increased ...

Offset inflation with better money habits

There is no denying that the cost of living for Australians is on the rise with inflation at 5.1%. But whilst we can’t control ...

Prison! The consequence of failing to lodge tax returns and BAS

A Western Australian doctor, has been sentenced to seven months in jail for failing to lodge 18 income tax returns and business activity statements ...

If you’re worried about government tracking, stop using the loo!

Fake news such as government tracking chips in vaccines is everywhere these days. Of course, the government is tracking you, but they don’t need ...

What costs more than champagne and Chanel No.5 perfume? Ink!

At $8296 per litre, standard black HP ink for your home printer costs more than champagne, designer perfume and human blood according to Choice. ...

The cost and benefit of Easter

Easter, Pascha or Resurrection Sunday is a ‘Christian festival and cultural holiday commemorating the resurrection of Jesus from the dead, described in the ...

The double-edged sword of inflation

We are experiencing record inflation (3.5% in Australia) (7.9% in the US and similar in Europe) resulting from the pandemic, global unrest, supply ...

The government wants you to spend big on tech!

The 2022/23 government budget allows small businesses to claim a 120% tax deduction on tech investment. For example, if you bought a $100 software ...

Australia has spent more than it earns since 1901

A budget deficit is when a government spends more money than it earns through tax and non-tax revenues. The Australian government with a few ...

Do I really need insurance?

For most of us, our human brain optimistically assumes bad things will happen to others but not to us. This survival wiring allows us ...

Think petrol prices will only affect you at the pump? Think again!

When the cost of crude oil goes up, every industry that uses fuel to run their business or produce their products must increase prices ...

Coal prices blow the roof off!

The invasion of Ukraine by Russia has shot the price of thermal coal to record highs. Why is this happening? Sanctions on Russia include ...

Are RAT tests tax deductible?

COVID‑19 tests are an important tool for mitigating transmission risks and absences from Australian workplaces. The federal government has promised to make all COVID-19 ...

Is virtual real estate a good investment?

The metaverse has taken the world by storm. Whilst it’s been in the gaming community for years, advancements in virtual reality and the explosion ...

If oil is a dinosaur, why is the price so high?

For years now, the consensus has been that oil is on its way out and renewables are in. Yet, the price of oil continues ...

How to turn your rental property into your first home

If you love your rental property and wish you owned it, you may be able to make it happen. Here are five tips to ...

‘Just in time’ inventory model doesn’t work in a pandemic

The ‘just in time’ inventory model (JIT) has become the gold standard in distribution. Touted as the most efficient distribution model, JIT is defined ...

Tech companies like Tesla have a monumental competitive advantage over traditional companies

Tech companies like Tesla have a monumental competitive advantage over traditional companies Tesla has a monumental competitive advantage over traditional car companies, and it's ...

New Year resolutions that kill two birds

Most of us set resolutions for the New Year, but very few achieve them. We often envision our perfect selves and set goals too ...

12 days of Christmas finance tips

12 days of Christmas Finance Tips On the 1st day of Christmas, I set out my financial goals for the New Year. On the ...

5 reasons to have an end of year bash for your employees

Here are 5 reasons why the benefits of an end of year party for your business will outweigh the costs: Strengthens staff cohesiveness and ...

How can accountants avoid COVID burnout?

Over the last two years, COVID has affected people’s income, business, freedoms, travel, health, relationships, financial future and mental health. COVID has impacted almost ...

Fastest growing Australian companies for 2020-21

In order of growth acceleration, the top 10 of the Australian Financial Review’s Fast 100 (fastest growing companies in Australia judged by their compound ...

House prices to crash by 10%

Gareth Aird, the head of economics at the Commonwealth Bank of Australia, has predicted a 10% correction for Australian house prices when the Reserve ...

Why are things getting more expensive around the world?

From property to cars to petrol to the price of your morning coffee, prices are going up. Why are we seeing global inflation in ...

Domestic demand continues to drive growth in 2021

Household (+1.1%) and public (7.4%) spending in Australia are responsible for our rise in GDP in 2021 over a 7% drop in 2020. Our ...

Australia’s labour shortage and the ‘wealth effect’

Pre-COVID, Australia was ripe with the rhetoric of foreigners stealing the jobs of hard-working Australians looking for a fair go. But if the pandemic ...

Is the 9-5 workweek entering the age of dinosaurs?

The COVID-19 pandemic has changed our lives in many ways but none more so than how and where we work. From lockdowns to restrictions, ...

Flagship phones are essential for small business

Here are 3 reasons that make a fast capable flagship smartphone essential for running your small business. Camera – You don’t need expensive equipment ...

What is salary sacrificing and is it for me?

It sounds like some sort of sacrificial ritual for your paycheck, but don’t worry it’s neither complicated nor sinister. Salary sacrificing is simply asking ...

Australia opens to the world in November – Get your business ready!

The Morrison Government plans to open Australian borders for vaccinated international travellers in November. Getting your business back to full capacity can be a ...

How much money will I need each year of my retirement to live comfortably?

Most of us don’t know how long we will live. As a result, it’s best to have a passive annual income in retirement rather ...

Top 5 questions to ask your accountant at tax time

Here are the top 5 questions that you should be asking your accountant, tax or business advisor during tax time. Are you a registered ...

3 tips for small businesses in lockdown

Whilst many large corporations in Australia have arguably benefited from a COVID economy, the bread and butter of our country, small business has been ...

Can employers mandate vaccination in Australia?

Vaccinations are free and voluntary under Australia’s current policy. There is no government mandate for vaccines. However, the federal government strongly recommends that all ...

Boeing and Airbus lose their duopoly

For decades, Boeing and Airbus have enjoyed an uninterrupted duopoly in the large commercial aircraft segment. New competition from the East threatens to burst ...

Disaster Recovery Payment vs Disaster Recovery Allowance

The Disaster Recovery Payment (AGDRP) is a one-time federal government payment for people affected by disaster ($1,000 per eligible adult and $400 per child). ...

Not taking a risk can sometimes be the biggest risk

Sometimes, choosing not to take a risk can pose the biggest risk. This rings true with the COVID-19 vaccine in Australia. Many who can’t ...

The dangers with share buy-backs

Many businesses find operating through a company structure is attractive as the profits are taxed at a flat rate of 26% (if turnover is ...

Australians don’t support high taxes

Following successive election losses, Labour has done a complete 180-degree flip on tax. They now support tax cuts for individuals earning up to $200,000 ...

Federal Government increases NSW COVID-19 Disaster Payment

The COVID-19 Disaster Payment in NSW will increase to a maximum of $750 per week for those who have lost over 20 hours of ...

How to post on your Facebook business page

Facebook has over 3 billion monthly active users. 12 million in Australia. 2.2 billion use it through their phone. Women between 18 – 24 ...

The $90b JobKeeper wage subsidy ended and the zombies fell

The JobKeeper Payment supported businesses significantly affected by the coronavirus (COVID-19) and finished on 28 March 2021. There were just over 1 million workers ...

15 per cent global minimum corporate tax rate

A new proposal for a 15 per cent global minimum tax rate by 2023 has been approved by the G20 finance ministers. The objective ...

NSW COVID-19 business support package – What you need to know!

A new grants package and Dine & Discover Program extension (vouchers for takeaway delivered to your home) has been created to support NSW business. ...

Get a $500 lockdown payment if you live in Sydney

Don’t have access to paid leave or the Pandemic Leave Disaster Payment? You can still get a $500 lockdown payment. If you live in ...

My car and tax, what can I claim as a business owner?

As a business owner, you can deduct the following expenses for a vehicle carrying less than one tonne and fewer than 9 passengers: fuel ...

Property tax reform

The states are asking the Australian federal government to adopt a new property tax system offering flexibility to home buyers. A buyer would be ...

Victorian Government Small Business Digital Adaptation Program

The Victorian Government announced some grants late last year but did not open them up for application until earlier this year. The Victorian Government’s ...

Accounting for cryptocurrency transactions for tax purposes

Cryptocurrency is a digital asset in which encryption techniques regulate the generation of units and verify transactions on a blockchain. Cryptocurrencies are usually independent ...

$2,000 Small Business Lockdown Assistance Grant – WA

Lockdowns, even short ones can have a huge impact on small business. If you are a small business, it is essential to understand what ...

How can a small accounting practice back up their data on a budget?

Backing up your practice data is essential. Loss of data can cause irreparable damage to a small accounting practice. The rule of thumb is ...

Intrinsic value, a measure of volatility and risk

Intrinsic value is a measure of what an asset is worth. This measure is arrived at through an objective calculation or complex financial model, ...

Emergency finance

Your financial wellbeing is intricately linked to your personal health. Our finances can rapidly spiral out of control without warning and in turn our ...

Apply principles of business management to personal finance – Prioritise, assess, restrain

Appy the 3 principles of business management to your personal finances - prioritise, assess and restrain. Prioritise – Take a good look at ...

Invest long term for predictable high returns

Share and bond markets go through cycles. It is exceedingly difficult to predict the bottom and tops of these cycles. The share market is ...

Using self-control to increase wealth

Self-control is defined as the ability to regulate behavioural, emotional, and attentional impulses to achieve long-term goals. Self-control early in life is a strong ...

Can you afford a rise in the cash rate?

With the Reserve Bank of Australia (RBA) keeping interest rates at historically low levels (currently 0.1 per cent) and competitive mortgage rates as low ...

Debt servicing costs should not exceed 30 per cent of income

Debt is useful for buying assets and leveraging to increase our wealth. But how much debt is too much? For the average Australian, debt ...

Eat your leftovers

The average grocery spend per week in Australia is $140. That equates to $6,720 per year. On average we throw away 20% of our ...

No interest loans

No interest loans can be accessed by those who need an immediate cash boost to get their heads above water. Individuals struggling with money ...

Surround yourself with success

Whether in your personal life, or business, you are only as good as the people around you. Choose successful friends and circulate with high ...

Have the money conversation with you partner

If it looks like your relationship is getting serious, have the money talk as early as possible. Whilst it might not seem romantic ...

Keep good records of your expenditure

Keeping good records of your expenses is essential to building wealth. For example, keeping your purchase receipts is critical for recording any claimable ...

Save money before you get it

The 'save money before you get it' strategy helps those who find it difficult to meet their weekly or monthly savings goals. It prevents ...

Here’s why you shouldn’t buy new!

When purchasing big-ticket items like cars and furniture, it’s tempting to go for the latest model or fashion trend. Whilst marketing campaigns are ...

Do not cosign a loan

At some point in your life, a relative, friend or colleague will ask you to cosign a loan. A cosigner ‘agrees to be responsible for a ...

Automate your savings

Putting your personal finance on autopilot can help you achieve your long and short-term financial goals. Implementation and cost Set up auto deposits into ...

Triple check your insurance

Insurance is an ongoing expense that must be justified. It is therefore important to triple check the fine print every year to ensure that ...

Upskill while employed

Don’t wait until your out of work to upskill. Speak to your current employer about paying for you to upskill right now. Benefits of ...

Get free unmotivated advice from a financial counsellor

Unlike financial advisors, financial counsellors offer free confidential financial advice and support through community, government, and legal centres. The benefit of financial counselling, aside ...

Pay off your student loan

When you attend university or an approved higher education provider, you can get a HECS-HELP loan to pay for your studies. Once your studies ...

Tracking your spending is the first step to financial control

The first thing we must do to take control of our personal finances is to find our how much we spend each month ...

The rise of MyTax and the fall of tax agents

In 2013/14, 74.2% of all individual tax returns were prepared by tax agents. Fast forward six years to 2019/20 and that figure had fallen ...

How to setup an emergency fund

It is important as part of your monthly savings strategy to set aside a specific amount to build up an emergency fund. Life is ...

Build wealth with compound interest

The old saying 'time is money' really is true. Compound interest is defined as interest on a loan or deposit calculated based on both ...

Technology can help you manage your personal finances

Managing your personal finances can be complicated and time consuming. It doesn’t have to be this way. Technology offers many free tools, apps, and ...

Exchange traded funds (ETFs) – Growing your money in a zero interest economy

Exchange traded funds (ETFs) offer a low cost, hassle free method to grow your savings with less risk than owning ordinary shares on the ...

Renegotiating your mortgage could save you thousands!

A mortgage rate is the rate of interest charged by your lender or financial institution for your mortgage. A mortgage is defined as a ...

Budgeting – A simple guide for everyone

Overview A spending plan called a budget allows you to determine how much you should be spending each week or month to reach your ...

Forget about tax and take a holiday in Australia!

It's been a tough year for everyone. From lockdowns and job losses to anxiety and mental health, 2020 has been a year to remember. ...

Taxing knowledge

The first tax on newspapers in Britain was introduced in 1712. Newspaper tax in the United Kingdom reached a height following the Napoleonic wars ...

Remember Twisted Tax Tales?

Do you remember our Twisted Tax Tales short story competition? You can still read over 150 crazy Twisted Tax Tales stories right here. So ...

Tech for Tax Agents in 2020

Here are our top 5 tech tools for tax agents: Logitech HD Pro Webcam C920 - Meet with your clients online with a crystal ...

What to do when your practice receives a fake Google review

Unfortunately we live in a world where some competitors feel the need to use dirty tactics in a futile attempt to rise above the ...

Does my accounting practice need a Facebook page?

Facebook business pages are a great way to show the human side of your business and build trust with potential clients by: Posting pictures ...

Time to fix the Australian economy

The Australian economy has been hitting a brick wall for years, bogged down by bureaucracy and indecisiveness. Policies are bundled together only to be ...

Professional accountant or elite athlete?

Would you be surprised if we told you that the makings of a great accountant are also the makings of elite athletes? In fact, ...

The origin of numbers

A number is a mathematical object used to count, measure, and label. 37,000 years ago, a Lebombo bone (part of a baboon's fibula) was ...

Is my idea strong enough to start a business?

We've all had that Eureka moment when we think wow, that would make a great business. Why hasn't anyone thought of this before? But ...

3 great selling techniques

In simple terms, selling is defined as giving or handing over something in exchange for money. No matter who you are, at some point ...

Success secrets from our top 10 growth practices

The average growth rate for our top 10 tax practices for 2019/20 was 45%. What were their secrets to success? "Franchisor support can make ...

Top 5 ways professional services can support clients during a lock-down

Communicating with clients is crucial for businesses to survive a lock-down. Your staff may be temporarily or permanently working from home. Here are 5 ...

5 great tools to help you work from home

Victoria has gone into stage 4 restrictions and many have no choice but to work from home for the foreseeable future. Here are 5 ...

5 things I wish I knew when I started my first business

When I started my first business 10 years ago, I wish I knew these 5 things: Registering a business as a company instead of ...

Startup companies are a lead indicator of business confidence

A business confidence index (BCI) provides information on future developments, based upon opinion surveys on developments in production, orders and stocks of finished goods ...

Now is the perfect time to buy a franchise

Franchising allows a business to operate under the established brand of another business. You (the franchisee) can sell their products and/or services for a ...

Getting the most out of your accountant during a COVID-19 lockdown

This is an incredibly stressful time for everyone in Australia and especially for Victorians who are facing yet another lockdown with no foreseeable exit ...

Now is a great time to review your career or change jobs

If you are thinking about a career change but have been putting it off, now is the time to make the move. COVID-19 has ...

The perfect time to start a business is right now!

The best time to begin a new business venture in Australia is right now! Starting a business is never easy. A whopping 90% of ...

Where are Australians spending their money?

According to research by Illion, our food delivery spend is up 259% from pre-COVID-19 days. We are buying more furniture than we used to ...

Communication – the most important part of a business continuity plan (BCP)

During a crisis such as the COVID-19 pandemic, we focus on survival. Businesses strip back and place every resource they have into the critical ...

Supercharge your tax accounting practice on Google Maps

6 easy steps to supercharge your tax accounting practice on Google maps; Add your practice to Google My Business. Visit Google My Business. Sign ...

Emergency super spent on pokies, beer, and Uber Eats

Whilst some Australians in desperate need, have used early super withdrawal to pay bills and debts or to invest in their future, others have ...

Enabling two-factor authentication for my accounting practice data

Is my data safe? No matter who hosts your data, if it’s online, it can be hacked unfortunately. Your data is arguably safer ...

IT security for accounting practices

If you are looking for a higher level of IT security for your accounting practice, here are some areas to consider. Your email and ...

$150,000 instant asset write-off for small business

If your business turnover is less than 500 million, you can instantly write-off any asset purchase up to $150,000. You must buy your assets ...

Don’t Let COVID-19 hold you back – Start a business

Thinking of starting a business? Don’t let COVID-19 hold you back. Here are some reasons why now is a really good time to get ...

Will business survive COVID-19

We are living through unprecedented times. Events and shocks to the health, business and financial systems are unfolding by the hour. We have never ...

Grow your accounting practice by helping your clients during COVID-19

To grow your practice, maximimise opportunities and help clients, you must do five things as accountants: Increase client communication. Send every business client details ...

Demand for accounting/tax services will grow over the next 12 months

Accounting/tax practices are fortunate to be providing an essential service during the COVID-19 pandemic. Demand for accounting/tax services will grow over the next 12 ...

Bartering free rent for services

Bartering free rent for services reduces your businesses rent costs to nil. For this transaction to occur, and be beneficial to both parties, it ...

Commercial leasing principles during COVID-19

The government is introducing a mandatory commercial leasing Code of Conduct (the Code). The Code imposes a set of 13 good faith leasing principles ...

Activity-based workspaces

Activity-based workspaces give employees the flexibility to work from different types of workspaces and choose the workspace that best fits their current work activity. ...

$130 Billion JobKeeper Payments

Background on JobKeeper payment Businesses, charities and not for profit entities impacted by the Coronavirus will be able to access a subsidy from ...

JobKeeper payments

Today the federal government have announced a new wage subsidy package. The key points include: $130 billion committed over the next six months to ...

Temporary relief for financially distressed individuals and businesses

On 24th March 2020, the Federal Government’s Coronavirus Economic Response Package Omnibus Act 2020 came into force. This legislation aims to provide temporary relief ...

Tax-Free Payments of $750 to Eligible Recipients

The Government is providing two separate $750 payments to social security, veteran and other income support recipients and eligible concession cardholders. The first payment ...

Temporary Early Release of Superannuation

The Government is allowing individuals affected by the Coronavirus to access up to $10,000 of their superannuation in 2019-20 and a further $10,000 in ...

Tax agents are considered essential services

As trusted advisers, we are being inundated with requests for information as clients and businesses turn to us to help navigate through uncertainty. The ...

Income support for sole traders

Overview The Federal Government has established a new, time‑limited Coronavirus supplement to be paid at a rate of $550 per fortnight. Payments will commence ...

Assign a lease to get rid of rental expenses

Assigning a lease transfers your rights under the lease to the new tenant. As you are no longer responsible under the original lease from ...

Increase sales to reduce rent as a % of sales

As rent is a fixed cost, increasing sales will reduce the rent cost as a percentage of sales. As a consequence, although the rent ...

How can a tax agent business survive a coronavirus outbreak?

Imagine this scenario - There is a coronavirus outbreak in your city during the busiest time of the year July - September. You will ...

Negotiate lease incentives to cut costs

Leasing incentives are financial concessions or upfront capital payments that landlords make to prospective tenants to entice them to commit to a binding lease ...

Demand a rent reduction – It’s the law

Although your lease agreement is a contract with your landlord, it will contain express (or implied) clauses regarding rent reduction in certain circumstances. If ...

Will an open plan office suit my business?

Open plan offices make use of large, open spaces, and minimise the use of small enclosed rooms. Open plan offices have been adopted by ...

Is hot desking just hype?

Hot desking involves multiple workers using a single physical work station or desk during different time periods. Hot desking is typically used where employees ...

Would a virtual office suit my business?

A virtual office provides businesses with the advantages of a prestigious address, landline phone numbers and team support without committing to dedicated office space. ...

Maximise workspace utilisation

Maximising space utilisation involves reducing workspace inefficiencies to reduce rental expenses without negatively impacting employees. Typical strategies to maximise space utilisation include: Reducing the ...

Negotiate a discount for prepaying 12 month’s rent

Subject to having the available funds, prepaying 12 month’s rent in advance has the following benefits: A 5-10% discount on the years rent expense ...

Sign a long-term commercial lease for rental concessions

Landlords prefer commercial tenants sign long-term leases (greater than 5 years), as this provides them with stability of income and a guaranteed ongoing tenancy. ...

Buy your business premises in your SMSF

This strategy involves purchasing your business premises in your self-managed super fund (SMSF). This has the following advantages: Your superannuation is used to partly ...

Consolidate your business space for immediate cost savings!

Consolidating space involves consolidating the business over fewer floors or office locations. Consolidating staff into fewer offices reduces rent costs in three ways: The ...

How to become an employer of choice

A business that meets all of its employee expectations is called an employer of choice. An employer of choice attracts, motivates and holds on ...

What is business process reengineering and does my business need it?

Business process reengineering (BPR) is the redesign of core business processes to achieve dramatic improvements in productivity, costs, cycle times and quality. BPR aims ...

Supercharge productivity with employee surveys!

Employee surveys are used by businesses to gain feedback and measure employee engagement, workplace culture, commitment, employee morale, and performance. Conducting regular employee satisfaction ...

The financial benefits of outsourcing

The financial benefits of outsourcing include reducing labour costs, increasing efficiency and reduced capital costs. The most important business benefit is that it enables ...

Is my business green and why should I care?

Sustainable businesses or green businesses have minimal negative impact on the global or local environment, community, society, or economy while maintaining a profit. In ...

All employees should sign an employment agreement

A written employment agreement is used to outline the wages and conditions for employees and will include information such as employer and employee details, ...

Is your business doomed to fail?

Although every business is started with optimism and hope, the reality is creating a profitable, successful business is tough. Statistically, 30% of businesses fail ...

Foreign Controlled Australian Company

An Australian resident company is a foreign controlled Australian company if any of the following apply: A group of five or fewer foreign entities ...

What are your obligations as a foreign company in Australia?

A foreign company intending to carry on a business in Australia is generally required to register with ASIC as a 'Registered Foreign Company'. Registered ...

How does Australia define a foreign company?

A foreign company is an entity that satisfies the definition of ‘foreign company’ in section 9 of the Corporations Act 2001 (Corporations Act) – ...

Delisted Company

Delisted companies are companies that have been removed from the Australian Stock Exchange (or the state-based exchanges), Newcastle Stock Exchange or the Bendigo Stock ...

ASX Listed Companies

The Australian Stock Exchange Ltd is an Australian public company that operates Australia’s primary securities exchange, called the Australian Securities Exchange (ASX). The ASX ...

Unlimited Public Companies with a Share Capital

An unlimited public company is a public company whose members have no limit placed on their individual liability to contribute to the debts of ...

Public Company Limited by Guarantee

A public company limited by guarantee is a specialised form of public company designed for non-profit organisations. 'Limited by guarantee' means that upon the ...

No Liability Companies

A no-liability company is a limited liability public company whose principal activities are restricted to mining or oil exploration. These companies are called 'no-liability' ...

Sexually Transmitted Debt

Sexually transmitted debt is where one person in a relationship becomes responsible for their partner's financial debts usually after being convinced or misled into ...

How to Grow Your Fees 31% in a Year

The ten fastest growing accounting practices in the Success Tax Professionals group increased their fees by an average 31% for the 2019 financial year. ...

5 Marketing Strategies to Grow Your Fees

Here are our top 5 marketing strategies to grow your business today. These strategies will stand the test of time regardless of changes in ...

Unlimited Proprietary Company (With a Share Capital)

An unlimited proprietary company is a private company whose members have no limit placed on their individual liability to contribute to the debts of ...

Software Review – Xero Tax

Andy Asiandi, (Payneham, SA) reviews the Xero Tax software. XERO Tax advantages: Free for Bronze Partners. Xero tax returns integrate nice and easily with ...

Difference Between Tax Agents and Tax Planning Specialists

Although Australia has 42,561 registered tax agents, less than 1% of these actually provide any specialist tax planning advise to their clients. Ninety nine ...

Should You Lodge Your Own Tax Return?

The Australian Tax Office (ATO) expects over 3 million Australians to lodge their 2019 tax returns through MyTax for free. You should do away ...

7 Unusual United States Tax Deductions

The United States tax code allows for many unusual but legitimate tax deductions and tax credits. Here are our top 7: Clarinet Lessons: A ...

Professional Gambler Winnings Are Tax Free

Australians are the most prolific gamblers in the world and lose over $24 billion per year gambling. Australia’s gambling losses of $1,200 per adult ...

The Top 10 Errors and Bias We Make When Making Decisions

Decision making is the cognitive process involving judgement to make choices. We make thousands of decisions each day and their importance and effect of ...

Are You Breaching Your Directors Duties?

Australia has over 2.5 million companies registered with ASIC, of which 98% are proprietary companies. All companies have directors, with proprietary companies requiring a ...

What does the Board of Directors Do?

The board of directors are the individuals responsible for the governance, control, management and strategic direction of the organisation. Boards are responsible for: Appointing ...

Tax Planning Referral Marketing System

Referral marketing is a method of promoting products or services to new customers through referrals, usually word of mouth. Such referrals often happen spontaneously ...

Tax Planning Software

Over the last the ten years tax planning software has taken an adhoc, manual, time consuming process to a new level of efficiency and ...

Calculating the Fee – Value Pricing

With value pricing the fee is based on the value added to the client, not the number of hours you spent working on the ...

Focus on Existing Clients – Not New Clients

When selling our services to clients we need to focus our attention, time and energy on our existing clients, not chasing new clients. Research ...

Educating Clients on Tax Planning

This involves educating taxpayers on the opportunities they have available to personally save tax. This step involves no selling at all, and is strictly ...

Tax Planning vs Tax Avoidance

'The difference between tax planning and tax avoidance largely comes down to intent. Tax planning, is organising your clients’ tax affairs in the most ...

10 Countries with No Income Taxes

Australia is a high taxing country and has a corporate tax rate of 27.5% or 30%, and marginal tax rates for individuals as high ...

5 Additional Services Small Businesses Would like to Receive from Their Accountant

The NAB ‘Key insights into the Australian accounting industry’ report found that accountants are failing to provide the services their business clients demand. The ...

Top 10 Tax Policies of the Australian Labour Party

Most bookmakers have the Australian Labour Party as unbackable favourites to win the May 2019 Federal election. As such, subject to successfully negotiations with ...

7 Weird Tax Deductions

Breast implants – In the US Chesty Love (a stripper) received a tax deduction for her size 56N breast implants as they were required ...

Eight Pets That Can Be Tax Deductible

Dogs on farms for rounding up sheep, cattle and other livestock.Fish at workplaces (office and factories). Birds at the workplace. Guard dogs at factories.Dogs ...

Finance Brokers Smashed by Banking Royal Commission

Since the Banking Royal Commission released its final report on 1st February 2019 finance brokers have not stopped crying. For Australia’s 16,000 finance brokers, ...

Property Values in Freefall

A negatively geared rental property is where borrowed funds are used to invest in property and the income generated (at least in the short ...

Ten Deductions Employees Should Never Have Claimed

Adult industry workers claiming breast implants.Employees claiming cigarettes for stress relief at work.Driving instructors claiming speeding and parking fines.Prescription glasses, contact lenses and hearing ...

9 Unusual Work Deductions

Adult industry workers can claim costumes, lingerie, fetish equipment, and adult novelties - if used solely for income earning purposes. Bar staff can claim ...

Abolish the Breastfeeding Tax

With the abolition of the tampon tax on 1st January 2019, women have now started campaigning to have the breastfeeding tax removed as well. ...

Government Targets $50 Billion Black Economy

The ‘Black Economy Taskforce’ report released in October 2017 shows the black economy has grown to 3% of GDP (up from 1.5% in 2012). ...

Black Economy Grows 100%

Since 2012 Australia’s black economy has grown 100% to $50 billion per year. This dwarfs the growth in Australia’s legal economy over that period ...

Tampon Tax Abolished on January 1, 2019

Eighteen years after its introduction, the 10% tax on tampons and pads was removed after states and territories agreed to make sanitary products exempt ...

Accountants Fail as Business Advisors

Australia has 2.2 million businesses, of which 2,065,523 are defined as small businesses (employing less than 19 people). The ATO statistics show 96.7% of ...

Accountants Obsessed with Themselves

With the explosion of social media over the last decade, accountants (like a large percentage of the population), have become obsessed with themselves. A ...

Business Profitability a Dismal 3.8%

Australia’s 2.2 million businesses produce an average return on shareholders’ funds after tax of only 3.8%. This paltry return is less than the risk ...

5% of Tax Practitioners are Breaking the Law

The Tax Practitioners Board (TPB) 2017/18 annual report highlights that only 95% of practitioners are compliant with all aspects of the law. For the ...

Registered Tax Practitioner Numbers Surge to 77,749

As at 30th June 2018 there are 42,561 tax agents, 15,638 business activity statement (BAS) agents and 19,550 tax (financial) advisers regulated by the ...

Where are the Innovative Accountants?

Have a read of the average accountant’s website, and the word ‘innovation’ keeps popping up. There is no doubt accountants have heard of the ...

Only 1% of Accounting Practices Provide Tax Planning Services

For the year ended 30th June 2018, 42,561 tax agents (RTA) and 19,550 tax (financial) advisers generated $330 million in tax planning revenue. This ...

Average Accounting Firm only has $257,625 Revenue

For the year ended 30th June 2018, 33,870 accounting firms produced revenue of $20b, a 1.5% increase over 2017. The Top 100 accounting firms ...

Top 100 Accounting Firms Record $11.3 Billion Revenue

The Australian Financial Review Top 100 accounting firms for 2018 billed $11.3 billion revenue. Amongst the top 100 firms there is a big divergence ...

Four Types of Introverts

It has been estimated that over 75% of accountants are introverts. This compares to the general population which has a 50/50 split between introverts ...

Accountants Failing to Invest in Themselves

The Tax Practitioners Board (TPB) Code of Professional Conduct (Code) requires registered agents to meet continuing professional education (CPE) obligations. The object of this ...

Role of the Accountant

Accountants who are members of professional bodies are required to act in accordance with the highest professional and ethical standards. These professional standards require: ...

Accountants Preparing Legal Documents

Accountants in public practice generally want to help their clients. Some accountants will do anything for their clients, even break the law. The most ...

Life Insurance for Dead People

Charging life insurance to dead people – how would that work? Just ask AMP - as highlighted in the Banking Royal Commission, AMP has ...

Financial Planners – More Than a Few Bad Apples

The Banking Royal Commission has delivered a scathing interim report on the practices of the financial planning industry. Unfortunately, it’s not just a question ...

The End of an Era for Accounting Practices

Accounting practices, as they are currently organised and operate, is coming to the end of an era – in the type of work they ...

The Fat Smoker

‘Strategy and the Fat Smoker’ is a book by David Maister which has the central theme that knowing what to do is usually easy ...

Accountants Stuck in the Inertia Trap

All the professions, accountants included, realise change is occurring with the professions. Most professionals realise that change in other professions is happening, is good ...

Tax Return Review Services

Subject to complying with the ATO amendment periods, all tax returns can be reviewed, and amended where necessary. Taxpayers who have changed accountants, or ...

78% of Tax Agent Prepared Returns Have Errors

The ATO’s ‘Individuals not in Business Tax Gap Report’ has found that 78% of tax agent prepared returns have errors. Paul Drum, CPA Australia ...

Unhappy with Your Tax Refund?

Taxpayers are often unhappy with the size of their tax refund, believing it should be bigger. Sometimes the taxpayers are right and they are ...

MyTax at Tipping Point

My Tax is at tipping point and accounted for 46% of all 2018 tax returns lodged up to 13/08/18. The ATO advised that at ...

Measuring Your Web Site Traffic

Measuring website traffic is the process of analysing the users who visit your website. Website traffic is measured in sessions or visits. The most ...

Top 10 Tax Planning Strategies for 2018

Tax planning is the process used by individuals and businesses to structure their affairs to legally reduce their tax liability. For the 2018 financial ...

How to Build a Referral Network

Word-of-mouth referrals are the number one method professional services firms get leads and gain new business. As 82% of business owners use referrals from ...

How Business Owners Search for Accounting Services

Australia has 2.2 million businesses with the average business owner being over 50 years old, and 84% over 35. The over 35 business owners ...

77% Fees Growth in 2018

The 4 fastest growing Success Tax Professionals practices for 2018 achieved an average 77% fees growth. The top 4 practices based on fee increases ...

Top 7 Reasons Businesses Fail

Although every business is started with optimism and hope, the reality is creating a profitable, successful business is tough. Statistically, 30% of businesses fail ...

The 3 Most Famous Accountants Throughout History

Luca Pacioli - the ‘Father of Accounting’ Luca was the first person to publish detailed material on the double-entry system of accounting. He was ...

Top 10 Tax Deductible Dog Breeds

Dogs can be a legitimate tax deduction when used for work or business purposes. The top 10 working dog breeds are: Labrador Retriever - ...

Top 10 Tax Deductible Utes

Utes used for work or business purposes will create tax deductions such as depreciation, lease payments, fuel, repairs, insurance, cleaning, and registration. The percentage ...

Phoenix Company

A phoenix company is a commercial entity which emerges from a collapsed insolvent entity. The new company trades under the same or similar name ...

2018 Federal Budget Targets the Black Economy

Australia’s black economy is a growing economic and social problem. It undermines the community’s trust in the tax system, creates an uneven playing field ...

Cashless Society

A cashless society exists when financial transactions are conducted not with money in the form of physical banknotes or coins, but rather through some ...

The Black Economy

The black economy is a clandestine market or transaction that involves illegality. This includes the drug trade, counterfeiting, prostitution (where prohibited), smuggling, illegal currency ...

Tax Agents Terminated by the Tax Practitioners Board (TPB)

The Tax Practitioners Board (TPB) regulates tax practitioners and administers the Tax Agent Services Act 2009 (TASA). They want to protect the consumers of ...

Free Tax Returns Through Tax Help

Low income earners can get their tax returns completed and lodged with the ATO for free through Tax Help. Tax Help is a network ...

$5 Billion GST Tax Gap

The tax gap is an estimate of the difference between the amounts the ATO collects and would have collected if every Australian taxpayer was ...

Nurses Rated Most Trusted Profession

The Roy Morgan Image of Professions Survey 2017 found that nurses topped the list of the most highly regarded professions. Over 94% of Australians ...

Company Incorporation Costs Slashed

Australia currently has 2.5 million registered companies and incorporates another 600 new companies every day (on average). Companies are a popular business/investment structure as ...

Garnishee Notices

Garnishee notices are a tool used by the ATO to collect outstanding tax debts from delinquent taxpayers. It is normally only used by the ...

No Escaping ATO Debts

ATO tax debts, like all debts, are legally enforceable obligations. The ATO collects these debts on behalf of the Australian Federal Government. If taxpayers ...

SMSFs Grow in Popularity

Self-managed super funds (SMSF’s) continue to grow in popularity with 30,000 new funds being established each year. Today, Australia boasts over 600,000 funds holding ...

Self-Funded Retirees to be Taxed to Death

The age pension provides basic income support for Australians who are above retirement age (currently 65) but are unable to fully support themselves by ...

ATO Help for Drought-Affected Businesses

The ATO has a variety of measures in place to help drought-affected taxpayers in financial hardship to manage their tax. The ATO assistance includes: ...

Is your Financial Planner Ethical?

This is a very important question that every financial planning client would definitely like to know the answer to. But in practice, how would ...

Notifiable Data Breaches Scheme

Effective from 22nd February 2018, the Privacy Amendment (Notifiable Data Breaches) Act 2017, establishes the Notifiable Data Breaches (NDB) scheme in Australia. The NDB ...

Disclosure of Tax Debts to Credit Reporting Bureaus

The Federal Government is legislating to allow the Australian Taxation Office (ATO) to disclose information on businesses tax debts to registered credit reporting bureaus ...

How Low Can Compliance Fees Go?

Compliance services are now completely commoditised. The commoditising of compliance services was inevitable really, and the only surprising thing is how long it’s taken. ...

Five Signs Your Tax Accountant is a Turkey

Although it may be politically incorrect to say so, the reality is not all tax accountants are equal. Just as all drivers are not ...

Accountants Embracing Outsourcing Overseas

Over ten years ago, forward-thinking Australian accounting practices started outsourcing part of their work and processes overseas. Initially, the outsourcing started with basic bookkeeping ...

Two Heads are Better Than One

The Australian accounting services industry is growing 1.5% pa and currently generates $20bn revenue (IBIS World Industry Report M6932). The industry is comprised of ...

How Long Before a Business Owner Does Not Need an Accountant at All?

Rob Nixon, in his latest book ‘The Perfect Firm’, asks this question ‘How long before a business owner does not need an accountant at ...

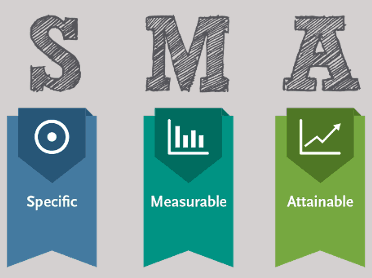

SMART Criteria

Specific, Measurable, Assignable, Realistic, Time Related SMART is a management acronym giving criteria to guide in the setting of objectives in project management, employee-performance ...

Australia’s Company Tax Rate Must Fall to 20 Percent

In December 2017, the US legislated through large tax cuts which reduced their company tax rate from 35% to 21%. With the UK company ...

Shop-Front Ground Level ‘Vs’ First-Floor Accounting Practices

We often get asked as to what is the percentage of walk-ins for shop fronts compared to say first floor or upper-level offices when ...

Tendering

Strategies for successful tendering Tendering is the process of choosing the best or cheapest company to supply goods or do a job by asking ...

Customer Segmentation in the Accounting Industry

An accounting practice has six main customer segments; Salary and wage tax returns Retirees and investors Self-managed super funds Micro small businesses Medium sized ...

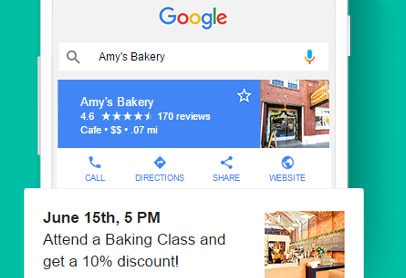

Competitive Advantage for Accountants that use Google’s New Posts Feature

If you own a small accounting practice, you would know that a Google Maps listing is essential for your business to be found online. ...

Five Strategies for Effective Client Communication

Effective client communication will retain more customers than any other method. Here are five strategies that will help you communicate effectively with your clients. ...

The Importance of Client Feedback

Client satisfaction feedback is critical if we are to improve the weaknesses in our client servicing, while continuing to build-on our strengths. We need ...

Consistency

The key to exceptional business results is consistency. If you do nothing else, be consistent. Consistency doesn’t mean being the best at something, or ...

Client satisfaction

Client satisfaction is defined as ‘the number of clients, or percentage of total clients, whose reported experience with a business, its products, or its ...

Maximising client retention

To maximise client retention, you should do five things. Firstly, keep a record of the clients lost, and clients gained. This includes the type ...

Five Factors Affecting Client Retention

The five factors affecting client retention are client satisfaction, client delight, client switching costs, client relationships, and client service standards. Client satisfaction - Unsatisfied ...

Client retention

Client retention is really any activity that a practice undertakes in order to reduce client losses. Client retention is about exceeding the client’s expectations so ...

The Trouble With Debt

The three ways accountants can get in trouble with debt financing their practice are: Using short term debt to make long term investments. Doing ...

Funding Established & Expanding Practices

Established practices have less funding needs than new practices as they are well established and producing ongoing revenue that covers the practice costs and ...

Funding New Accounting Practices

Accounting practices, like all businesses, require funding to start, operate, and grow. The funding requirements of practices vary depending upon whether they are a ...

Service Guarantee

The 18th century entrepreneur Josiah Wedgewood pioneered the satisfaction-or-money-back guarantee as a marketing strategy on the entire range of his pottery products. He took ...

Introducing New Services to Existing Clients

This strategy is about creating new services that you can provide to your existing client base. It is similar to the low hanging fruit ...

Selling Existing Services to Existing Clients

For a practice wanting to achieve organic growth this strategy is best described as ‘low hanging fruit’. It is simply about ensuring that every ...

The Effect of a Good Office on Productivity