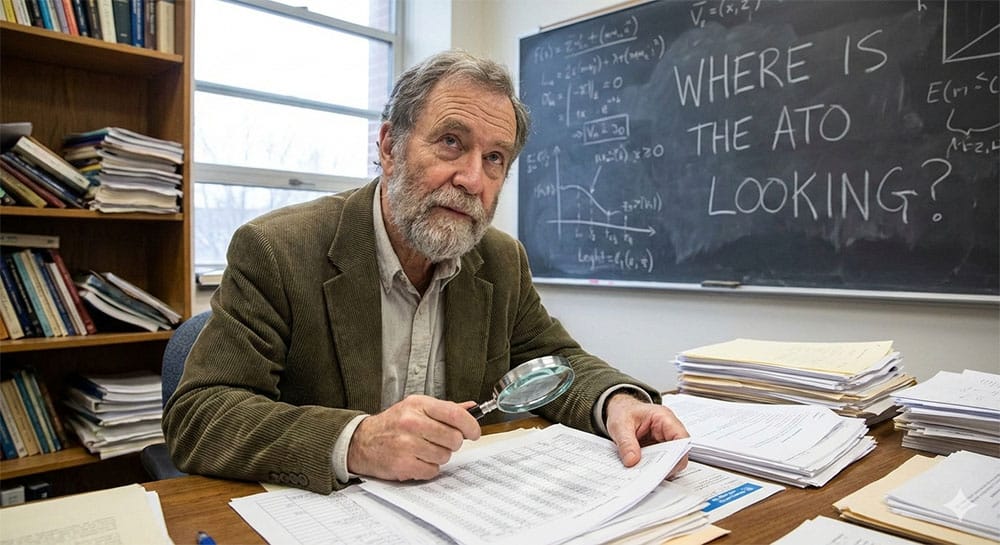

Actuaries, mathematicians & statisticians, this is where the ATO is looking

If your work is analytical, computer-based and highly technical, the ATO already knows the pattern.

That’s why claims for equipment, software, study and work-from-home get extra attention.

Here’s the reality.

What usually stands up (when it clearly relates to your current role):

- Professional memberships (e.g. Actuaries Institute)

- CPD, conferences and training that maintain or deepen existing skills

- Technical books, journals and data subscriptions

- Computers, monitors and accessories (items over $300 are depreciated)

- Specialist software (R, SAS, SPSS, Python, modelling platforms)

- Work-from-home running expenses (approved methods, with records)

- Work-related travel (not daily commuting)

- Professional indemnity insurance (if you pay it personally)

What usually gets knocked back:

- Office clothing and footwear

- Meals, coffee and snacks

- Home ↔ workplace travel

- Study for a new career or future promotion

- Claiming 100% of phones, internet or devices with no apportionment

- Home office occupancy costs (high audit risk unless strict tests are met)

Where the ATO applies pressure:

- No evidence of work vs private use

- “Self-education” that’s really a career change

- Work-from-home claims with no hours log

- Software or subscriptions with no clear work purpose

Simple example:

$2,400 modelling workstation.

Used 70% for work.

You claim 70% of the depreciation, not the full cost.

The ATO isn’t trying to stop legitimate deductions. They’re stopping over-claims, assumptions, and poor record-keeping.

If you’re in a technical role and want your tax done properly, defensibly, and without pushing the audit line, speak to your local Success Tax Professionals adviser.

Fixing it later always costs more than doing it right the first time.

General information only. Advice should be tailored to your circumstances.