Posts by Success Tax Professionals

Agricultural & forestry scientists, stop guessing your tax deductions

Crops, livestock, soils, forestry, climate modelling or remote field research, your deductions must be tightly linked to your current duties.

Read MoreAged & disabled carers. Are you claiming the right deductions?

If you work in aged care or disability support, you may be entitled to more deductions than you realise, but you need to get them right. Here’s what can be deductible (when related to your current role): ✅ CPR, manual handling & infection control training ✅ First aid refreshers & required care certifications ✅ Employer-required scrubs, non-slip footwear & protective…

Read MoreAdvertising & marketing professionals – what you can and can’t claim

If you work in advertising or marketing, your deductions can add up quickly, but this is also an area the ATO watches closely.

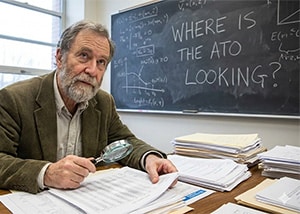

Read MoreActuaries, mathematicians & statisticians, this is where the ATO is looking

If your work is analytical, computer-based and highly technical, the ATO already knows the pattern. That’s why claims for equipment, software, study and work-from-home get extra attention. Here’s the reality. What usually stands up (when it clearly relates to your current role): Professional memberships (e.g. Actuaries Institute) CPD, conferences and training that maintain or deepen existing skills Technical…

Read MoreThe $1,000 deduction won’t hurt all firms, only the ones built on volume

The $1,000 standard deduction won’t wipe out accounting firms overnight. It will do something far more dangerous. It will quietly remove work.

Read More$1,000 standard work-related deduction

From 1 July 2026, the ATO is introducing a $1,000 standard work-related deduction. If your deductions are $1,000 or less.

Read MoreChristmas parties, gifts & tax: what actually works!

They spend good money on Christmas parties and gift and accidentally make them tax-inefficient.

Read MoreJob costing tells you what happened. Benchmarking tells you whether it’s acceptable

In my last post, I talked about why most businesses don’t actually know which jobs make them money.

Read MoreMost small businesses don’t actually know which jobs make them money

From an accountant’s point of view, job costing is gold. It turns vague conversations into commercial ones

Read MoreThe fastest way for small businesses to grow? expand their sales channels

Most small businesses hit a growth ceiling for one simple reason: They’re selling in the same place, in the same way, to the same customers.

Read More