Category: accounting

Advertising & marketing professionals – what you can and can’t claim

If you work in advertising or marketing, your deductions can add up quickly, but this is also an area the ATO watches closely. Here’s ...

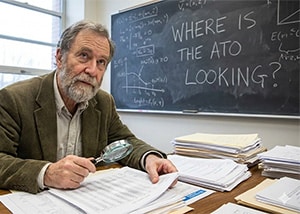

Actuaries, mathematicians & statisticians, this is where the ATO is looking

If your work is analytical, computer-based and highly technical, the ATO already knows the pattern. That’s why claims for equipment, software, study and work-from-home get extra ...

The $1,000 deduction won’t hurt all firms, only the ones built on volume

The $1,000 standard deduction won’t wipe out accounting firms overnight. It will do something far more dangerous. It will quietly remove work. Australia has ...

$1,000 standard work-related deduction

From 1 July 2026, the ATO is introducing a $1,000 standard work-related deduction. If your deductions are $1,000 or less, you’ll be able to claim ...

Christmas parties, gifts & tax: what actually works!

Every December I see businesses make the same mistake. They spend good money on Christmas parties and gift and accidentally make them tax-inefficient. A ...

Most small businesses don’t actually know which jobs make them money

They think they do. They don’t. Sales are up. The bank balance says otherwise. When we look under the bonnet, the issue is usually ...

What Really Drives the Value of a Bookkeeping Practice?

When most bookkeepers think about selling their practice, they focus on one number: revenue. But buyers don’t buy revenue, they buy recurring revenue, stable systems, ...

Actors, dancers & entertainers – what you can and can’t claim at tax time

Entertainers have some of the most complex deduction rules of any profession. Between auditions, rehearsals, performance gear, headshots, and constant skill development, it’s easy ...

Accounting clerks: what you can and can’t claim at tax time

If you work as an accounting clerk, bookkeeper support, or in an admin/finance role, tax time can be confusing. We see a lot of people ...

The referral system every accounting practice should be using

Most accountants say referrals are their best source of new clients — but very few have an actual referral system. And that’s the problem. Good referrals don’t ...