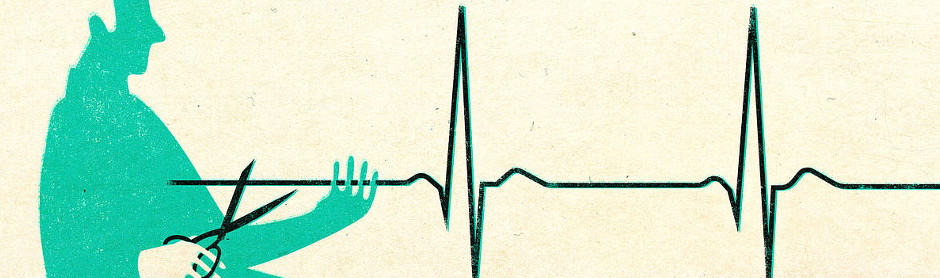

Self-Funded Retirees to be Taxed to Death

The age pension provides basic income support for Australians who are above retirement age (currently 65) but are unable to fully support themselves by their own means. When the age pension was introduced in 1909 it was only accessed by a small proportion of the population. This was because the male life expectancy at birth was only 55, whilst you needed to reach 65 to qualify for the pension benefits.

Australia currently has 2.1 million people receiving the age pension. At an annual cost to the federal budget of $46 billion the aged pension makes up 40% of the Government’s welfare payments. Eighty percent of retirees rely on either full or part, pension benefits.

As the name implies, self-funded retirees fund their own retirement. This is normally achieved through a combination of thrift (saving), investment, and inheritances. Both of the main political parties are keen to levy extra taxes on the self-funded retirees. The Liberal Government did this by introducing the $1.6 million pension balance cap on 1st July 2017. This ensures that even in retirement (pension phase), the earning on super fund balances in excess of $1.6m are taxed.

The Labour Party proposes to remove franking credit refunds which will cost taxpayers $5b per year. The biggest losers from this plan will be self-funded retirees with pension accounts. As they have no taxable income, the franking credits will be lost. For many self-funded retirees, this will be a loss of $10,000 income per year.