Category: Business

Why is China slashing interest rates?

As the rest of the world tightens monetary policy by hiking interest rates, China is slashing rates. Two rate cuts in August and a ...

Challenges for Australian businesses in 2022

2022 is a tough triple whammy year for small, medium and large businesses in Australia. Businesses, already shaky as they pull themselves out of ...

Simple tax returns to disappear within 3 to 5 years

Chris Jordan, the Commissioner of Taxation, has advised tax agents that 'if your business model is high-volume, low-margin, simple tax returns, your business will ...

The Pros and Cons of a Country Accounting Practice

There are many benefits to moving your accounting practice to the country. Rural accounting also comes with a lot of risk and potential downside, ...

How to manage poor-performing employees

Human capital is often the biggest cost to a business. Employees must perform at their best for your business to succeed. But what if ...

How to protect yourself from malicious spam emails

Spam emails are unauthorised electronic messages sent in bulk from outside parties. The intent varies, some promote legitimate products or services whilst others link ...

Conventional vs unconventional monetary policy

Conventional monetary policy is a central bank tool that changes the cost to borrow money (official cash rate/interest rate) to increase or reduce demand. ...

Should I use myTax or an accountant?

If you’re an individual with a simple income from an employer and nothing to claim, you may decide to lodge your tax online through ...

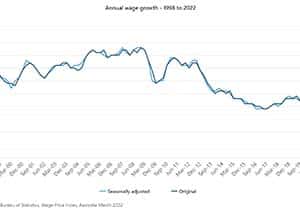

Wage Price Index, Australia (WPI)

The Wage Price Index Australia (WPI) is a measure of the cost of labour not considering compositional changes in the workplace such as part-time vs full-time employment. ...

Am I human or computer?

What you’re reading right now is written by me. But am I human or computer? Chances are, you’ve read multiple articles this year written ...