Posts by Success Tax Professionals

Should I use myTax or an accountant?

It would be wise to see an astute accountant over myTax to ensure you stay within the law, and help maximise your claims.

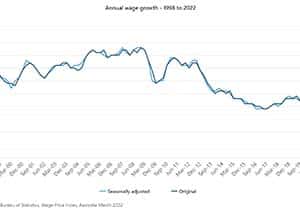

Read MoreWage Price Index, Australia (WPI)

The Wage Price Index Australia (WPI) is a measure of the cost of labour not considering compositional changes in the workplace.

Read MoreTop five tax automations in Australia in 2022

Tax time doesn’t need to be arduous. Here are the top 5 tax automations for Australians in 2020. myTax, Xero, Receipt Scanner, Stripe.

Read MoreHow much extra will my home loan repayments be?

Now that interest rates are heading back up again, it’s important to figure out how much extra you will need to pay each week in the future.

Read MoreSharp rise in Living Cost Indexes (LCIs)

The Selected Living Cost Indexes (LCIs) in Australia have risen sharply over the last 12 months (3.8%-4.9%).

Read MoreFinancial markets are crashing, what should I do?

If you have a share portfolio, you might not be sleeping very well as you watch billions disappear from the Australian Stock Exchange (ASX).

Read MoreHow can you guarantee safe shopping online?

Here are four essential checks before buying from an online store to ensure an enjoyable shopping experience with maximum safety.

Read More$31.65 for a loaf of bread baked at home

if you put a price on labour, a single loaf of bread baked at home will cost over $30 because of economies of scale.

Read MoreAm I human or computer?

What you’re reading right now is written by me. But am I human or computer? AI is producing content faster, better and cheaper than humans.

Read MoreThe Howard government was the last to make any real tax reform

The Howard government’s incentive based GST tax policy was Australia’s last substantial tax reform that stood the test of time.

Read More