Posts by Success Tax Professionals

Taxing knowledge

Government taxes kept news out of reach for the working class. The first tax on Newspapers in Britain was introduced in 1712.

Read MoreRemember Twisted Tax Tales?

Do you remember our Twisted Tax Tales short story competition? You can still read over 150 crazy Twisted Tax Tales stories right here.

Read MoreTech for Tax Agents in 2020

Here are our top 5 tech tools for tax agents. Meet with your clients online with a crystal clear mic and high definition video at 1080p.

Read MoreWhat to do when your practice receives a fake Google review

Some competitors use dirty tactics to try and beat competitors. Follow these steps when your practice receives a fake Google review.

Read MoreDoes my accounting practice need a Facebook page?

Facebook business pages are a great way to show the human side of your business and build trust with potential clients.

Read MoreTime to fix the Australian economy

The Australian economy has been hitting a brick wall for years, bogged down by bureaucracy and indecisiveness.

Read MoreProfessional accountant or elite athlete?

Would you be surprised if we told you that the makings of a great accountant are the also the makings of elite athletes.

Read MoreThe origin of numbers

37,000 years ago, a Lebombo bone (part of a baboon’s fibula) was found in a cave in the Lebombo Mountains in Africa with 29 distinct notches.

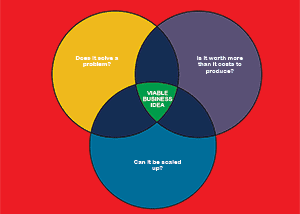

Read MoreIs my idea strong enough to start a business?

We’ve all had that Eureka moment when we think wow, that would make a great business. Would your great idea really make a viable business?

Read More3 great selling techniques

The best form of selling achieves a perfect outcome for both parties involved, the seller and the buyer. Here are 5 great selling techniques.

Read More