Category: Business

Does my accounting practice need a Facebook page?

Facebook business pages are a great way to show the human side of your business and build trust with potential clients by: Posting pictures ...

Time to fix the Australian economy

The Australian economy has been hitting a brick wall for years, bogged down by bureaucracy and indecisiveness. Policies are bundled together only to be ...

Professional accountant or elite athlete?

Would you be surprised if we told you that the makings of a great accountant are also the makings of elite athletes? In fact, ...

The origin of numbers

A number is a mathematical object used to count, measure, and label. 37,000 years ago, a Lebombo bone (part of a baboon's fibula) was ...

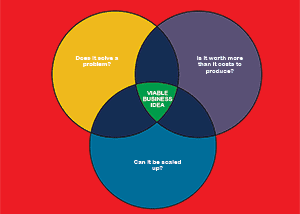

Is my idea strong enough to start a business?

We've all had that Eureka moment when we think wow, that would make a great business. Why hasn't anyone thought of this before? But ...

3 great selling techniques

In simple terms, selling is defined as giving or handing over something in exchange for money. No matter who you are, at some point ...

Success secrets from our top 10 growth practices

The average growth rate for our top 10 tax practices for 2019/20 was 45%. What were their secrets to success? "Franchisor support can make ...

Top 5 ways professional services can support clients during a lock-down

Communicating with clients is crucial for businesses to survive a lock-down. Your staff may be temporarily or permanently working from home. Here are 5 ...

5 great tools to help you work from home

Victoria has gone into stage 4 restrictions and many have no choice but to work from home for the foreseeable future. Here are 5 ...

5 things I wish I knew when I started my first business

When I started my first business 10 years ago, I wish I knew these 5 things: Registering a business as a company instead of ...